GET A QUOTE OR MAKE A CLAIM.

Contact your BMW Authorised Dealership to get a quote or to make a claim. BMW Financial Services is here to assist you.

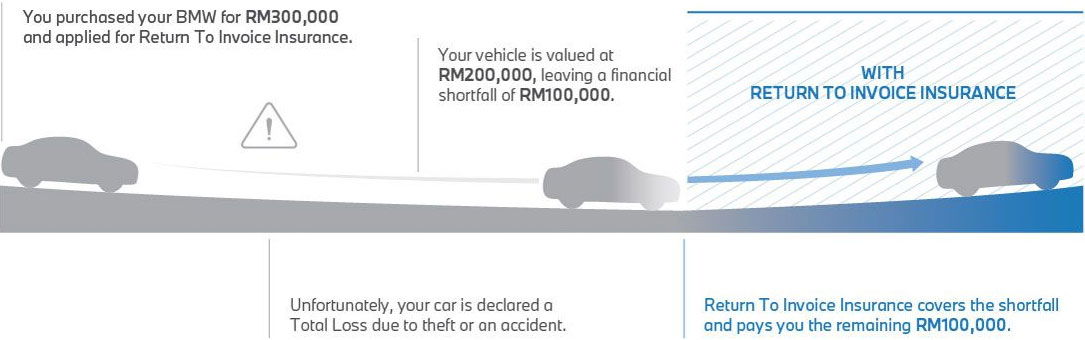

For full terms and conditions of BMW Return To Invoice Insurance, please download the policy wording handbook.